Delaware's New Rules Are a Cost To Consider When Forming Your Entity Delaware recently increased the various fees assessed by their Secretary of State as Annual Franchise Tax Fees for Delaware corporations. While the changes do not apply to Limited Liability Companies...

Garrett Sutton, Esq Articles and Resources

Estate and Gift Tax Exemptions Increased for 2018

The Internal Revenue Service (IRS) just announced new rules for 2018. First, the estate tax. In 2017, an individual could pass with $5.49 million in assets and not be subject to any federal estate tax. This amount is doubled for married individuals (or $10,980,000.)...

Using LLCs to Hold Paper Assets

Many of our clients hold their stocks, bonds and other paper assets in the name of an LLC. If sued personally they will benefit from the charging order protections in strong states like Wyoming. Conversely, if they hold brokerage account(s) in their individual name a...

Lessons from a New York Court Case on Piercing the Corporate Veil

Some business owners and investors don't understand the importance of keeping business and personal dealings separate, and can end up paying for it. Especially, when they are treating their business like their alter ego as was the case in this unfortunate New York...

Do You Own California Real Estate? Courts Create New Tax for LLCs Holding Real Estate

Owners of LLCs Holding California Real Estate, Beware! The State of California is at it again. A recent case decided by the California Supreme Court allows cities to asses Documentary Transfer Taxes like never before. When property is transferred by a deed, counties...

New IRS Rules for LLCs and LPs Require Amending Operating Agreements Immediately

The IRS has instituted new audit rules which require every LLC Operating Agreement and Limited Partnership (LP) Agreement to be amended. While we have never experienced such a dramatic requirement, it is important to make document amendments before December 31, 2017....

Safe Deposit Security for Wyoming LLCs

Holding LLC Certificates in Wyoming for Superior Protection with Armor8® You want the best protection possible for your assets. You want to use the strongest entity available. But if you live in a weak asset protection state (like California) and set up your LLCs in a...

13 Tips for Responding to IRS Notices

Contributed by Robert W. Wood, Tax Lawyer and Managing Partner with Wood LLP. Everyone must pay federal income taxes. Yet exactly how much you owe, and on exactly how much, is famously complex. All tax returns must be signed under penalties of perjury. That means you...

Is Your Website Ready For ADA Compliance?

New Court Case May Indicate Future Requirements Winn-Dixie, a large supermarket chain, was sued under the Americans with Disabilities Act (ADA). Juan Gil, a blind Florida resident, went to court because the chain's website was not accessible to him. The ADA requires...

Registered Agent Service Could Save Sued Business Owners Big Money

Every corporation, LLC, or limited partnership is required to have a registered agent, sometimes called a resident agent, to collect important legal documents for the business. This includes a service of process in the case of a lawsuit. Many small business owners opt...

Offshore Asset Protections Diminished

New Court Case Minimizes the Protections Offered by Offshore Asset Protection Entities with U.S. Offices At Sutton Law Center and Corporate Direct we don’t provide offshore asset protection, so if you want to use the Cayman...

Strong State LLCs Can Protect You From Excessive Charging Orders

Does the state you incorporate in determine how much someone can collect from you after losing a lawsuit? The answer is yes. Read on to see how this works. What Is a Charging Order? A charging order is a lein on distributions from an LLC. When someone sues you and you...

Is Your Business Ready for a Cyber Attack?

Is your business dependent on technology? Think about it. Do you use a computer at work? Do you accept credit card payments? Unless you are collecting cash out of a cave, there is a good chance your business uses 21st century technology to conduct its operations. And...

Corporate Attorney and Asset Protection Expert, Garrett Sutton, Featured on Bravo

Garrett Sutton, Corporate Attorney and Asset Protection Expert, was recently a featured guest on Hollywood Live. The show was filmed by an Emmy Award winning crew in the penthouse of the Hollywood Roosevelt Hotel that overlooks Hollywood Blvd, in Los Angeles,...

Is It Best to Do Business as a Sole Proprietor?

You like the ease of operation as a sole proprietor. There are no annoying state fees and no bothersome annual meeting requirements. Corporations must follow corporate formalities—and you’re not into formalities of any kind. Doing business as a sole proprietor is...

What is a Registered Agent? And Why Do I Need One?

Every corporation, LLC, or Limited Partnership must have a registered agent (also known as a "resident agent," "statutory agent" or "agent of process") in their state of formation, and in any state the company qualifies to do business in. The registered agent ensures...

Effective Wyoming LLC Strategy for Asset Protection

Wyoming LLCs: Strong. Affordable. Private. These three features make the Wyoming LLC the entity of choice for clients serious about asset protection. Strong Wyoming offers the strongest asset protection law in the country. The charging order lien is the exclusive...

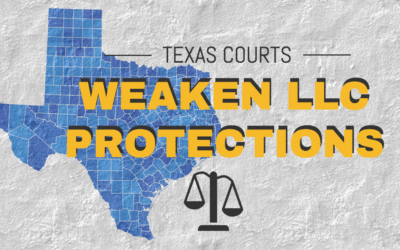

Texas LLCs Lose Charging Order Exclusivity Protection

Texas used to be considered a strong LLC state. But strength can evaporate with one court decision, which happened in Texas in August, 2016. In Devoll v. Demonbreun, 2016 WL 4538805 (Tex.App. August, 2016) Rebecca Demonbreun went to court and won $114,000 from Norris...

How Real Estate Professionals Can Use Rental Losses as a Tax Write-off

Are you a real estate professional? Do you work over 750 hours a year on real estate activities and are these annual hours over half the time you work in total? If so, you can offset real estate losses against your ordinary, taxable income. If one spouse is a doctor...

Protect Yourself from CPN Number Scams

by Scott Cooper There are countless services in the marketplace that aim to protect and improve your credit. While many of them can be helpful, some can be dangerous. One of the dangerous, but popular services being offered are credit privacy numbers. These are also...

How to Pay for Your Child’s College Education with UTMA Accounts

by Scott Cooper When it comes to planning for their child’s financial future, parents are presented with a vast array of options. But, transferring property to minors can create a number of problems for parents trying to bestow assets to their children. While many of...