Can you be held liable for the losses and failings of an independent business? A business you had no contractual relationship with? In California you can. Do you agree with the court’s decision? The case is Apex Directional Drilling, LLC vs. SHN Consulting Engineers...

Running a Business Articles and Resources

Reports Now Required for Foreign Investors in the USA

If you are a foreign citizen or business investing in the U.S. this article is important to you. All U.S. business enterprises with a new foreign investment totaling 10% or more must file the BE-13 Survey within 45 days of the transaction, or risk fines of $25,000 and...

A Guide to Doing Business Internationally

Learn Various Facets of Doing Business in 39 Countries As business becomes more global, it becomes even more important to appreciate how local it remains. This is to say that there is not one global standard for doing business: How you conduct a meeting, How you...

What Founder Traits Make Business Plans Successful?

If you're reading this, you've likely made the decision to turn your dream into a business plan. It’s an exciting step and you are to be commended. Most people’s fear of failure and inability to take risks are stronger than their desire to live their dreams. That’s...

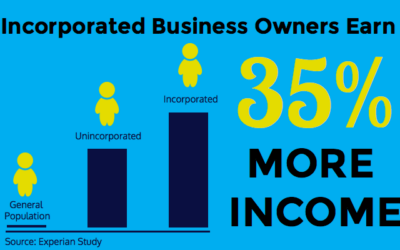

Why Incorporate? Here Are 6 Good Reasons

There are many advantages to incorporating your business and assets by using the proper business entity. In fact, without it, you'll have difficulty building business credit, which is often necessary for growth and stability. You'll also be vulnerable to losing your...

Keep in Mind These Home Office Zoning Issues

By Garrett Sutton, Esq. Where you do business will certainly affect costs, but that should not be your only concern. Here are 5 hazards to consider before deciding to work from home. 1. Zoning & Residential Restrictions If you’re doing business out of your house,...

10 Steps for Payroll Compliance

Payroll definitely requires good bookkeeping and a healthy paper trail. Whether you are hiring a bookkeeper or a bank or payroll service or not, you must make certain that all of the employee payroll-related documentation is on file. The W-4 and I-9 forms signed by...

Maintaining a Stock Ledger to Protect Your Corporate Veil

By Garrett Sutton, Esq. I frequently mention documents that you need to maintain to protect your corporate veil. Maintaining your stock ledger is another way to help protect your veil, which protects your assets. Read on to learn more about a stock ledger. When stock...

A Sole Proprietorship is a BAD Idea!

By Garrett Sutton, Esq. Each entity choice has its pros and cons. There is no one-size-fits-all corporate entity that will be the best for every situation. (And beware of the advisor who tells you there is.) However, there is one entity that we call the "bad entity."...

How to Incorporate in Nevada

Nevada is one of the best places in the United States to incorporate because its asset protection and privacy laws are among the strongest. Nevada is the only state to offer charging order protection to corporate shares. We'll cover more about this later....

Beware of the IRA Prohibited Transaction Scam

By Garrett Sutton, Esq. Have you ever been told you can make incredibly beneficial investments using your self directed IRA monies? Buyer beware. IRAs, as most people know, can offer significant tax deferrals, thus allowing for retirement accounts to grow over time....

The Short-Sighted End of Offshore Banking

By Garrett Sutton Facing government resistance at every turn and increased costs of doing business, foreign banks are now ever more hesitant to operate in America. Compliance costs for handling U.S. accounts are already so high that many banks are simply refusing to...

Good Standing: Are You in Good Standing?

When it comes to corporations, LLCs and Limited Partnerships, good standing is a legal requirement. And the consequences of not being in good standing, while unfortunately unappreciated by most, can be devastating. Good standing sounds important. It conveys the sense...

How to Avoid Improper Accounting Practices

By Garrett Sutton, Esq. Many new business owners make the mistake of not properly accounting for it all. Please know that companies live and die by numbers. They are defined by numbers. They grow with numbers. They bleed with numbers. Numbers define the health of your...

Corporate Paperwork

Paperwork for your corporation, LLC or LP is important. A failure to have it in place can lead to piercing of the corporate veil and the imposition of unlimited personal liability. Piercing the corporate veil is when someone gets a judgment against the company (ie:...

7 Business Insurance and Tax Deductions

Here are seven business insurance items that could be worth a tax deduction. According to the IRS, you can generally deduct premiums for these types of insurance which are related your business: Insurance covering losses from fire, storm, theft, accident or similar...

New Rules for Foreign Accounts Held By U.S. Citizens

By Garrett Sutton, Esq. The new Foreign Account Tax Compliance Act (FATCA) becomes effective July 1, 2014. The IRS reporting is straight forward. The penalties for not reporting are onerous. The Internal Revenue Service (IRS) requirements for FATCA are set forth in...

Electing a System of Accounting for Your New Business

It’s that time of year: Tax Time. Since I, too, have taxes on my mind, I thought I would spend the next few weeks blogging about some tax and bookkeeping related items that will help you and your new business get off to a good start. Before you start operating your...

Choose Your Tax Year

Continuing our theme of taxes, another key tax choice you need to make when starting up is your fiscal year. You can choose to have your company’s fiscal year end at the end of any month, but be aware that federal taxes are due 2.5 months after the end of your fiscal...